The West Bengal Authority of Advance Ruling (WBAAR) has ruled that there will be an Applicability of GST in case of wastage of gold in Jewellery...

Gold! It stirs many an emotion in an Indian family’s mind. When gold demand picks up, the economics makes the policymaker’s plan shine. The joy that...

All India Gem & Jewellery Domestic Council (GJC), the apex body of gems and jewellery industry, has sought to reduce the GST rate on jewellery to...

Chief Minister Pinarayi Vijayan has said that the government will take stringent measures, including augmented inspections in jewellery shops, to prevent tax evasion in gold jewellery...

For an industry that is huge and an important player in the country’s Gross Domestic Product (GDP), there is not enough being done to promote it....

The StayInTouch programme to help retailers showcase their inventory The gem and jewellery industry always preferred offline sales. However, Covid-19 has disrupted this practice and has...

Gold prices in Indian edged higher today, in tandem with an advance in global markets. On MCX, gold futures rose 0.25% to ₹46,124 per 10 gram, after...

The country’s retail trade lost business worth Rs 9 lakh crore in the last 60 days, mainly due to the nationwide lockdown to contain coronavirus pandemic,...

70 percent of the retailers in India expects the business recovery to happen in more than six months due to the ongoing COVID-19 crisis which has hit the retail sector...

Kolhapur : All India Gem and Jewellery Domestic Council (GJC), the apex domestic council of the gems & jewellery industry, conducted the 60th“Labham” educational programme for jewellers...

Always a pricey possession, gold is set to remain more pricey in the New Year too as continuing geopolitical tremors, economic woes and rupee volatility are...

‘Higher export credit limit is a positive’ The GST rate reduction and corporate tax rate cuts will enhance ease of doing business, boost exports and make...

Industry bodies hope to allay fears of job losses and uncertain future Surat’s diamond industry fears that its worst nightmare will come true. Ahead of the...

The jewellery export body welcomes the resumption of this facility. The government has again permitted gold and silver jewellery exporters to replenish the precious metal duty-free...

“I am stuck in this phase of life where I cannot go ahead or go back. The situation has been the same for two months. One...

There is a transitional shift in buying behaviour of consumers for gold jewellery in North India. With buyers preferring organised retailers over unorganised traditional family jewellers,...

GJEPC is seeking a package from the Government to revamp the entire gem and jewellery sector in lines with what has been given by the Government...

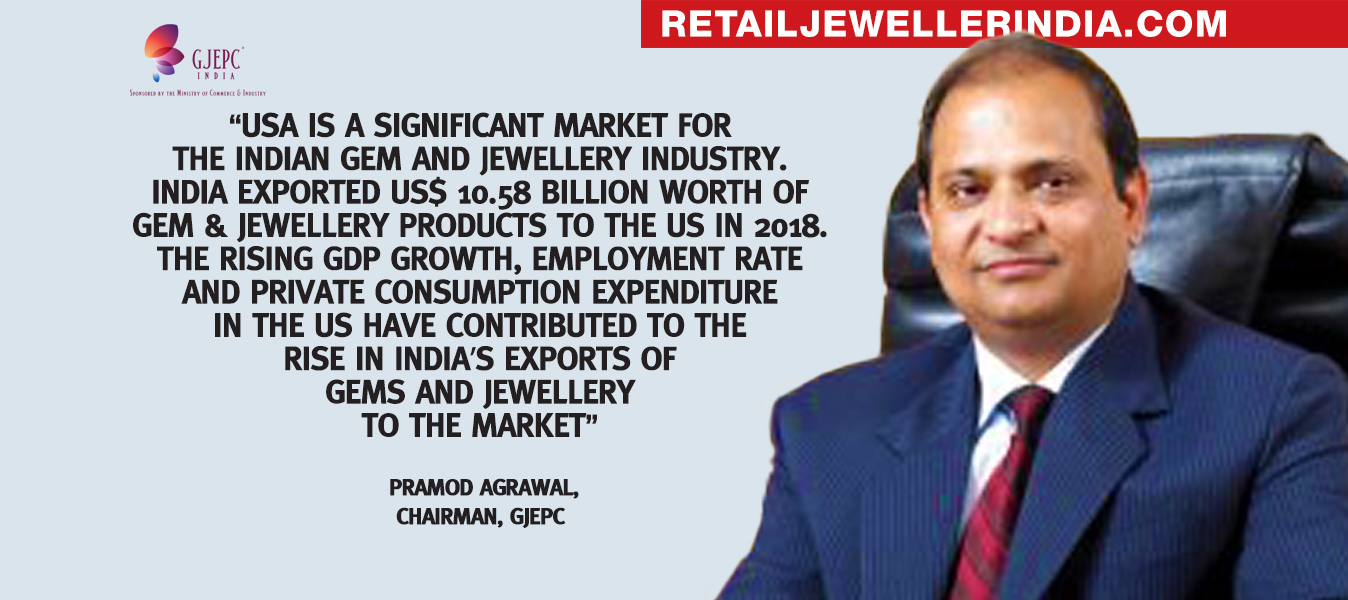

The withdrawal of duty benefits by the US under the Generalized System of Preferences (GSP) is yet another blow for India’s gems and jewellery sector. The decision, which came...

Union Budget 2019 India: The gems and jewellery sector expects the government to cut down the existing rate of import duty on both gold and diamonds in...

The Hon’ble Finance Minister Smt Nirmala Sitharaman today convened a meeting in Delhi with leaders of different industry segments as part of the pre-budget consultations. The...

India’s exports of gems and jewellery, a major component of the country’s trade basket and among its star forex earners till recent year, has hit the...

NEW DELHI: Back in office, the Modi government is set to take up the next stage of action against tax evasion and money laundering with data analysis helping detect thousands of overstated...

Kerala’s imposition of a 0.25% flood cess on gold sales to customers would not have a material impact, believe industry sources. The state government said in...

Positioned as India’s first workwear jewellery collection for women, Mia by Tanishq has over the last year, more than doubled its storefront and increased its online...

Much against general perception, demonetisation and Goods and Services Tax (GST) regime appeared to have no bearing on the voting behaviour of the trade and business...

All invoices for business-to-business sales by entities beyond a specified turnover threshold will be generated on a centralised government portal by September, a move aimed at...

Despite a steep increase in gold prices, jewellers in Gujarat seem ready to welcome buyers in large numbers this Akshya Tritiya as they have purchased 183...

Purchasing gold and investing in the yellow metal has been largely considered auspicious, as far as the buying preferences in India are concerned. A number of...

March 28: Shares of Titan Company has joined the elite club of Rs 1-trillion market capitalisation (market-cap) after hitting a new high of Rs 1,129, up 1 per cent on...

Mumbai: Gem & Jewellery Export Promotion Council (GJEPC), a nodal trade body sponsored by the commerce ministry, is pursuing banks to adopt its online know your-customer databank of 2,500 exporters as a...

A day after the model code of conduct came into force, the Coimbatore Jewellery Manufactures Association submitted appealed to the state election commission to not disturb...

Giving free gold coins could prove expensive for businesses as it is unlikely to be classified for input tax credit (ITC). In sync with the Authority...

Sale of gem and jewellery is likely to drop 10-15 per cent in the current financial year due to Goods and Services Tax (GST), high gold...

In a relief to buyers of high value cars and jewellery, the CBIC has said that the TCS amount would be excluded from the value of...

The persistent decline in bank lending for exporters, delay in refund of input tax credit and the fear of a withdrawal of duty-free export benefits by...

The Indian diamond industry has a historical background. The industry upholds the Indian ecosystem and further, contributes to incrementing exports. Primarily, the Gem and Jewellery sector...