RJ Market Watch

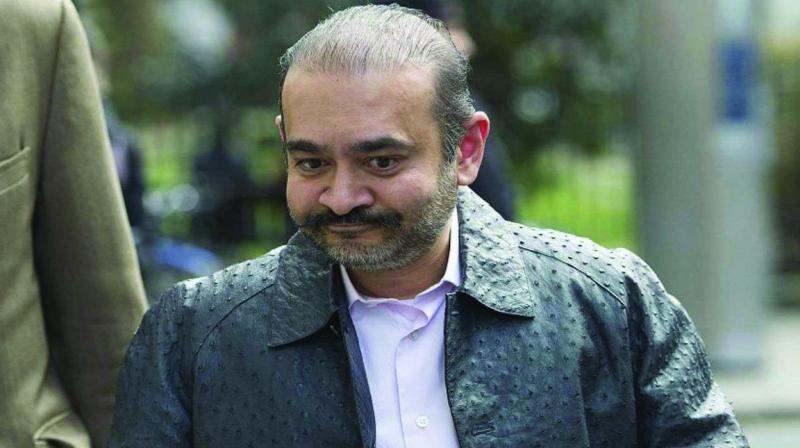

PNB Fraud Case: Nirav Modi Used Dummy Firms to Divert Bank Loans, Says ED

The Enforcement Directorate (ED) on Tuesday filed its second chargesheet in the Rs 14,356 crore PNB fraud case, naming 10 individuals and 17 entities, including members of Nirav Modi’s family. The chargesheet said Rs 6,400 crore of funds obtained via letters of undertaking (LoUs) was diverted to buy real estate and personal property and used for purposes other than stated through layers of “dummy companies” located overseas.

“A maze of transactions to obfuscate the investigation and to cover the tracks of money laundering was unearthed by obtaining foreign bank accounts and financial statements of various foreign dummy entities through various sources,” the ED said.

The charge sheet elaborated how funds raised through fraudulently secured LoUs were used to buy property in the US and set up a new chain of jewellery stores.

In 2017, Modi purchased property worth $25 million in the US in the name of Ithaca Trust. However, the funds for purchase were traced back to Fine Classic FZE, a Dubai-based dummy company of Nirav Modi’s sister, Purvi Modi. This company was one of the recipients of the funds obtained through the fake PNB LoUs, the ED alleged in the chargesheet.

In 2017, Modi purchased property worth $25 million in the US in the name of Ithaca Trust. However, the funds for purchase were traced back to Fine Classic FZE, a Dubai-based dummy company of Nirav Modi’s sister, Purvi Modi. This company was one of the recipients of the funds obtained through the fake PNB LoUs, the ED alleged in the chargesheet.

Money from Fine Classic was transferred to Purvi Modi’s account in AmiCorp Bank & Trust in Barbados. It was then transferred to an account of Ami Modi maintained with HSBC in the US. The money was then moved to an account of Purvi Modi maintained in the Bank of Singapore and then to a trust called “the commonwealth trust company”, before finally landing up with Ithaca Trust, the charge sheet stated.

At least $47 million was diverted to set up a new chain of jewellery stores in the US, the ED said. Funds obtained via the fake LoUs were also used to repay advances received through the LoUs, it said.

“Repayment of advances taken by Nirav Modi and Deepak Modi, father of Nirav Modi, from the dummy recipients of LoU funds to the tune of $18 million and $92 million, respectively, were shown as discharged in lieu of receipt of funds from Pacific Diamonds purportedly on behalf of Nirav Modi and Deepak Modi. It is ironical that the source of funds for Pacific Diamond is also illegal LoU money,” the ED alleged.

A consultant firm in Dubai was appointed to incorporate at least three layers of companies in Dubai. It is the third layer of companies that were the direct recipients of the funds obtained through the fraudulent LoUs.

Nirav Modi had also planned to exploit the foreign direct investment (FDI) route for circular transactions, the ED alleged.

“In 2017, Nirav Modi planned to rotate the LoU funds and reinvest the same into Firestar India by showing it as FDI investment through two companies namely Alecust Global Holding Limited, Mauritius and Progress Investment limited, Cyprus,” the ED added in the chargesheet.

So far, the agency has provisionally attached assets worth Rs 1,873 crore, including foreign immovable properties, bank accounts and jewellery worth Rs 961 crore.

The ED also refuted allegations that the agency was not responding to requests for information from British authorities.

“It is submitted that no formal or informal communication was received by the Enforcement Directorate from UK authorities in March 2018 or at a later date informing that Nirav Modi was in UK,” according to a separate press statement by the agency.

Courtesy: Mint

Personal Opinion1 month ago

Personal Opinion1 month agoBuy-back on gemstones to be on par with gold; A fear of return on the investment, more among high-end clients: Ankur Anand, Harsahaimal Shiamalal Jewellers

Exclusive2 months ago

Exclusive2 months agoPrasad Jewellers’ Gold Bar Challenge fulfils multi-channel engagement goals, attracts young customers

Maverick Greenhorn2 months ago

Maverick Greenhorn2 months agoSegmenting retail approach to boost business performance

Daily News1 month ago

Daily News1 month agoTBZ – The Original launches its first store in Jaipur