RJ Market Watch

Kalyan Jewellers: Striking gold

He spends a lot of time in the corner office of a plain vanilla building in the heart of Kerala’s commercial town of Thrissur, but billionaire businessman T.S. Kalyanaraman is never out of touch with his customers. Almost every day, the 72-year-old chairman and managing director of Kalyan Jewellers phones customers for feedback on products and service quality. One day in May, for instance, Kalyanaraman’s secretary, through a random selection of numbers from the company database, connected him with two customers: one from Mohali in Punjab and the other from Chennai in Tamil Nadu. “At first the customers don’t know who I am, but I do let them know that it’s a feedback call I’m taking,” says Kalyanaraman.

The customer from Chennai had no complaints, but the one from Mohali had a request. “He wanted to know if a particular piece of jewellery at our Mohali store could be made available in less weight [of gold],” Kalyanaraman, who has a degree in commerce from Thrissur’s Sree Kerala Varma College, tells Fortune India. He adds that that’s the most frequent feedback he gets as less weight means lower prices. Kalyanaraman takes such suggestions seriously and if a jewellery design can be tweaked to meet a customer’s request, the product is remade.

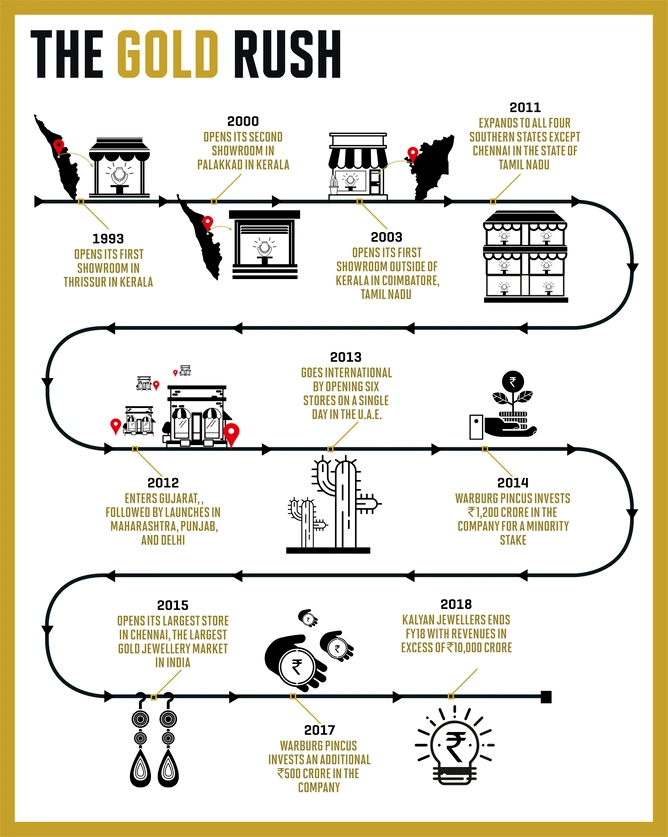

‘The customer is king’ has always been Kalyanaraman’s credo since he opened the first Kalyan Jewellers store in 1993 in Thrissur, home to over 1,000 gold manufacturing units. In fact, keeping in touch with customers is an old habit he’s had since 1972, the year he joined his father’s textile shop in Thrissur. And his sons, Rajesh,44, and Ramesh,41, who practically spent their teenage years at the first store, have followed the same mantra on the way to making Kalyan Jewellers India’s second-largest jewellery brand. “We have served coffee and tea to customers and have done everything a salesman in a showroom can do. That is why we can understand exactly what a consumer wants,” says Ramesh Kalyanaraman, executive director at Kalyan Jewellers.

Listening to their customers helped them strike gold. Today, the brothers jointly run the company with Ramesh overseeing marketing and operations, and Rajesh in charge of finance and inventory. Kalyan Jewellers operates 103 stores in India and 34 across the U.A.E., Oman, Qatar, and Kuwait. Growing at a compound annual growth rate of over 10% since FY15, the Thrissur-headquartered jewellery chain notched up revenues of ₹10,580 crore in FY18. While FY19 numbers are yet to be assessed, the expectation is the company will post more than ₹11,500 crore in revenue. “At that time, there was no concept of ready-made jewellery, everybody was working on orders. We opened a 4,000 sq. ft.air-conditioned store that stocked ready-made jewellery,” says Rajesh Kalyanaraman, executive director of Kalyan Jewellers and Kalyanaraman’s older son. “The idea was unique and clicked very well.”

Kalyan Jewellers has been on a roll. Over the past three years, it has on average opened 15 stores a year and plans to maintain that growth momentum going forward. Ramesh says that at least one store in every state they operate in clocks more than ₹100 crore in revenue and they have a 90% repeat customer rate in stores that have been operating for three years and above. On the international front,the company will soon be expanding to Bahrain, its fifth country in West Asia. With these big expansion plans, the Kalyanaramans have also set themselves a target to grow Kalyan Jewellers into a ₹25,000-crore revenue company by 2025. “I’m just supervising everything,” quips Kalyanaraman, whose ancestors were priests. Even today his family has a close association with a 100-year-old Sri RamaTemple in Thrissur and as devotees of Lord Rama, the name ‘raman’ is suffixed to their names.

Kalyanaraman’s grandfather was the first to enter business when he started a textile mill in Thrissur in 1908. Many years later, his father set up a textile store, Kalyan Ram Textiles, which was expanded to five stores—he built one for each of his five sons. Kalyanaraman, the oldest son, took over his father’s textile store but aspired to do more,which led him to expand into the jewellery retail trade. It was again an idea that came from customer feedback at his textile store. “Since many customers did their wed-ding shopping at the store, they suggested that I start a jewellery showroom, too,” says Kalyanaraman. “Also, by then my family had earned the trust of a lot of customers, while in jewellery retail there was no standard for purity.”

Today, every jeweller worth his salt produces a certificate of authenticity for gold, diamonds,and precious stones in jewellery-obsessed India. “But when they [Kalyan Jewellers] started off, they were the pioneers,” says Raghu B.Viswanath, chairman and chief vision holder of Vertebrand, a brand value advisory and marketing consultancy. Ramesh says they have spent a lot of time educating customers on the purity of gold and concepts such as making charges,which for years were shrouded in opacity. “When we entered the industry, you didn’t know what the making charges on jewellery were even if you had an invoice in front of you,” says Ramesh.

Viswanath says Kalyan Jewellers used “celebrity endorsements to the hilt” to spread the message of trust. When the company started out, it roped in Mammootty, a megastar in Kerala, to deliver the message. “He was a person that consumers believed in,” adds Ramesh. As it expanded its footprint across the southern states of Karnataka, Tamil Nadu, and Andhra Pradesh (then an undivided state),the company signed on the sons of legendary actors Rajkumar, Sivaji Ganesan, and Akkineni Nageswara Rao. Seven years ago, when the Kalyanaraman family decided to grow the business beyond the south, they felt the only celebrity who could carry their message to a larger audience was Amitabh Bachchan. “The [value of] inventory we had at our first showroom in Gujarat was similar to the marketing expenses of Mr Bachchan,”says Ramesh. Today, Kalyan Jewellers has a star-studded line-up of brand ambassadors from Bachchan and his wife, Jaya Bachchan, to southern megastars Prabhu Ganesan, Akkineni Nagarjuna, Shiva Rajkumar, and Manju Warrier.

It isn’t just the Indian market that’s taken a shine to Kalyan Jewellers. About 20% of its revenue comes from its international operations. “While trust and transparency are important for consumers in this sector, only a few brands have been able to consistently deliver on this promise over a long period of time,” says Anish Saraf, managing director, Warburg Pincus India,the Indian arm of U.S.-based private equity major Warburg Pincus which has more than $43 billion in assets under management. “Consumer surveys continue to reveal that Kalyan [Jewellers] ranks highly along these lines.”

In 2014, Warburg Pincus in-vested ₹1,200 crore in Kalyan Jewellers for an undisclosed minority stake and a few years later topped up its investment with an additional ₹500 crore. Back then,it was the largest private equity in-vestment in a jewellery company in India and also the largest in a Kerala-based company.

“Growth has been positive, driven by demographic trends such as rising incomes, a young population, and an increasing number of women in the workforce, among others. So when we looked at the consumer and retail space, we found this was a very interesting category to be in,” says Saraf.

Competition is stiff with an estimated 300,000 players in the business. The unorganised trade still accounts for almost 70% of India’s $75-billion gems and jewellery industry, but a host of big brands have also entered the market over the years. In 1995, two years after Kalyan Jewellers was launched, the Tata group’s Titan Company launched its jewellery business under the Tanishq brand. Today, with 256 showrooms across 159 towns and cities in India, and revenues of over ₹13,000 crore in FY18, Tanishq is the largest branded jewellery retailer in the country. It also operates 16 Mia stores, a sub-brand that essentially caters to a younger audience.

“Tanishq has beautifully shifted the mindset of Indian women—from jewellery purchase being an investment to saying that jewellery should be visible on a person,” says Viswanath of Vertebrand. “Be it through the launch of Mia, everyday wear jewellery collections, or economically priced diamonds, Tanishq has been able to break the consumer mindset.” Adds Saraf of Warburg Pincus India, “The largest pan-India brand [Tanishq] would account for 4 to 5% of the [jewellery] market, with Kalyan close behind and then there is along the tail of other brands.”

Kalyan Jewellers, which operated just a single store in Thrissur from 1993 to 2000, has demonstrated the ability to scale across regions. A key reason for its success is its focus on hyper localisation in a country where the ultimate symbol of wealth is gold. In 2000, after a gap of seven years, Kalyanaraman decided to open his second store in Palakkad, 70 km from Thrissur. It was this store launch that first taught the family the importance of hyper localisation in the jewellery business. “People here wanted chunky jewellery, but at a lower price,” explains Ramesh.

Three years later, when Kalyan Jewellers opened its fourth store in Coimbatore, Tamil Nadu, less than 60 km from Palakkad, it learnt another lesson. Despite the close proximity of the two cities,crossing the border was easier said than done. “In Kerala, during the wedding season, people purchase jewellery a week to 10 days before the marriage ceremony. In Tamil Nadu, right from the time when a girl child is born, parents start investing in gold jewellery. So before marriage, only a few pieces of old jewellery are exchanged for new ones, and no fresh investment is made,” says Ramesh.

Such learning points have only added to the brand’s lustre. Kalyan Jewellers has about nine jewellery sub-brands and retails over 70 kg of gold jewellery a day. It also operates an online jewellery brand Candere, which it acquired in 2017 for an undisclosed sum, as it looks to cash in on the small, yet burgeoning e-commerce space in the country. Muhurat, the wedding collection, is its biggest sub-brand,accounting for nearly 50% of its revenues. And it is in this collection where hyper localisation is most visible as products vary even within a state. “While most jewellery chains have not been successful outside their core regions, Kalyan has successfully localised its approach across each city it enters in areas of procurement, product mix, and in-store retail experience,” says Saraf. “This localised approach to each of their markets has been one of their key competitive advantages.”

Despite the success, Kalyanaraman and his sons have an under-stated elegance about them. For one, the company corporate office in Thrissur belies their riches—they are arguably the only business family in Kerala to own two private jets, an Embraer Phenom and an Embraer Legacy 650, and at win-engine Bell helicopter. While the helicopter is used to shuttle the family from their home in Thrissur to Kochi airport, drastically cutting down travel time to just 10 minutes, the jets ferry them around the country and overseas to West Asia.

Every month, the family visits one state or overseas territory to meet staff and customers. In April, they visited their stores in Dubai. “Eight years ago, when we bought our first jet, we had begun to expand across India. At that time, there were fewer commercial flights and we found it difficult to travel,” says Rajesh, who will now be jet-setting even more often as he prepares to take the company public over the next 18 months. Work on identifying a lead banker is underway. “Given that the business model is working well and there is a desire for continued expansion, an IPO is a logical next step for the company to raise capital to fund further store openings,”says Saraf.

Also, being in the public market for a consumer company is always good as it provides greater visibility. India’s big listed jewellery companies include Titan Company, PC Jeweller, Rajesh Exports,and Tribhovandas Bhimji Zaveri.“In our view, while being listed facilitates an exit down the road,we primarily consider an IPO to be more significant as a capital-raising milestone for the company rather than an exit-related one for Warburg Pincus,” clarifies Saraf.

While it still is to be seen how their IPO fares, the Kalyanaramans are banking on the image of trust and transparency that they have carefully built over the past 26 years. As one private equity investor points out, “It’s almost like how Xerox has become synonymous with the photocopy.”

Courtesy: FortuneIndia

Daily News2 months ago

Daily News2 months agoBvlgari adds designs to its pathbreaking mangalsutra collection ahead of wedding season

Daily News1 month ago

Daily News1 month agoTrent, a TATA subsidiary, launches lab-grown diamond brand ‘Pome,’ shares surge 7.67%

Daily News2 weeks ago

Daily News2 weeks agoMalabar Gold & Diamonds launches ‘Heritage Show’ in Mangalore, featuring jewellery inspired by Maharanis

Daily News3 weeks ago

Daily News3 weeks agoSavji Dholakia’s visionary water conservation project ‘Bharatmata Sarovar’ reinforces commitment to sustainability