Prime Story

GJEPC delegation met up with Hon’ble Commerce and Industry Minister in Mumbai today to represent G&J Sectoral issues

GJEPC is seeking a package from the Government to revamp the entire gem and jewellery sector in lines with what has been given by the Government to other employment intrinsic sectors like leather and textile. This is crucial and instrumental for the growth of the gem and jewellery industry in India.

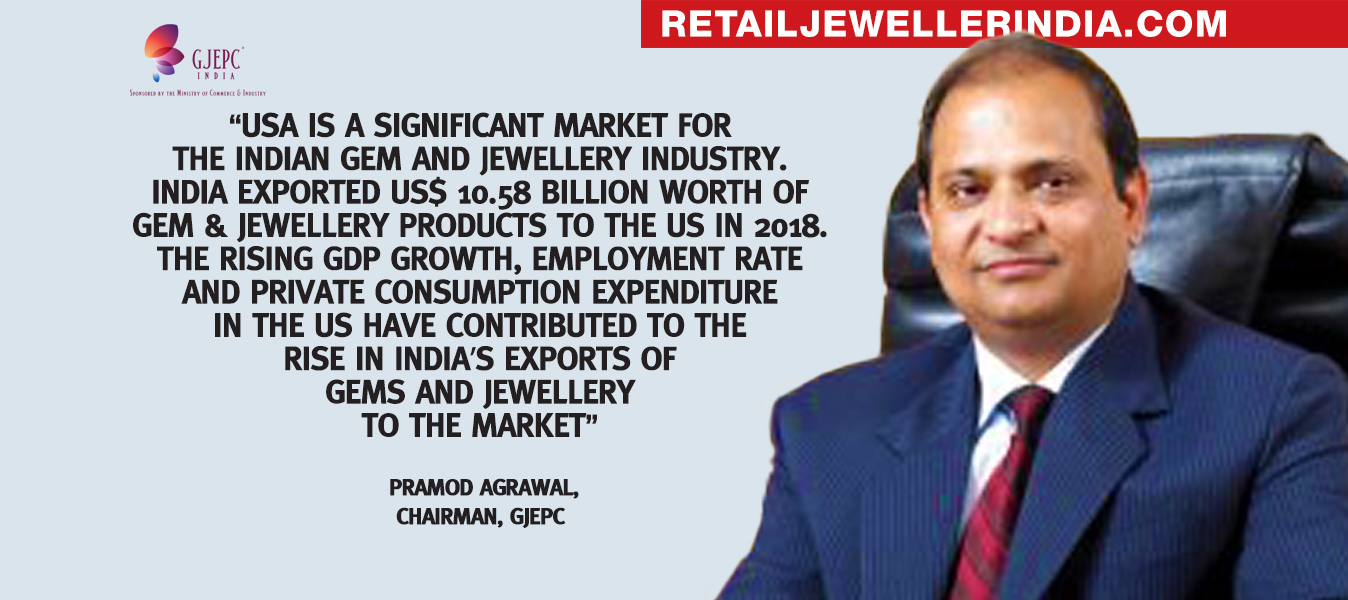

The Gem & Jewellery Export Promotion Council (GJEPC), concerned with several challenges restricting the sector’s growth, held a meeting today with the Hon’ble Union Minister of Commerce & Industry, Shri Suresh Prabhu, and the Director General of Foreign Trade (DGFT). The GJEPC delegation was led by the organisation’s Chairman Pramod Kumar Agrawal.

Some of the hurdles facing the gems and jewellery industry are the devaluation of the rupee; increased duty on imports of cut & polished diamonds; increased tax on gold; liquidity crunch and challenges at customs and ECGC. These have together resulted in a sharp drop of exports in the past few months: gems and jewellery exports witnessed a decline of 21% in September 2018, and is expected to decrease by a further 15% in October 2018.

GJEPC fears that there is a possibility of business moving to other centres like Vietnam, China, Thailand, and Indonesia.

“The recent increase of customs duty on categories of diamond such as semi-processed, half cut or broken, and cut and polished coloured gemstone to 7.5 per cent from 5 per cent, announced earlier on September 26, by the government with the aim of narrowing the current account deficit has hit the trade hard,” a GJEPC representative said. “The cutting and polishing units are witnessing sluggish demand and factories are going on early Diwali break.”

The import duty on precious metal currently stands at 10%, and, since last year, it has also started attracting 3% IGST. The Government of India had exempted specified banks and Public Sector Units (Nominated Agencies) from payment of IGST on import of gold; but the same has not benefitted the jewellery exporters as they are still bearing upfront IGST/GST on procurement of gold for the purpose of manufacture of jewellery for exports, which leads to working capital blockage and consequently impacts the global competitiveness of this segment.

Around 60% of the total gems and jewellery exports out of India take place through the Mumbai port. At present, this key port is going through extremely difficult times, which is critically hampering the export and business of various small and medium jewellers. The key issues include the introduction of Standard Operating Procedure (SoP) for the appointment of values and valuation thereof for valuation of export/import parcels at PCCCC, Mumbai; and implementation of Risk Management System (RMS) for appraisal and valuation of diamond and jewellery at PCCCC, Mumbai.

The Special Economic Zones were conceived as special growth engines of the country. The primary objective had always been the restriction-free export of all items from these zones providing full operational flexibility to all the units. Unfortunately, in the field of gems and jewellery, units are facing numerous challenges which defeat the objective of setting up of these zones. These include: SEZ units being allowed to do job work for companies in the DTA; allowing the sale of gems and jewellery items in the domestic area; allowing the sale/subletting of SEZ premises; single LOA for all categories of one chapter heading. The LOA period should be indefinite and delinked with land lease; there is a need for the simplification and rationalisation of all export documentation for reducing transaction time and cost, and for promoting e-commerce platform for gems and jewellery exports from SEZ.

Another factor that has stalled the business of the gems and jewellery industry is the lack of bank finance. “Post the February crisis, the sector has faced major liquidity crunch since March this year with a 10-15% decline in bank finance which has adversely impacted exports out of the country,” GJEPC noted. “Banks and financial institutions have been stringent on lending norms with demands for higher collateral security against the bank finance extended to the trade.”

Apart from this, another critical issue – which the industry has been flagging for long — is ECGC’s withdrawal of credit risk cover to SSI and large exporters. The GJEPC has time and again asked that ECGC continue its policy to cover the credit insurance risk for the gems and jewellery sector.

The GJEPC has proposed that the ECGC create an exclusive diamond credit guarantee cell for better monitoring of the industry. Further, companies with limits up to Rs. 100 crore should be given WTP so that the MSME/SME segment thrives and the risk is spread with a well-diversified portfolio. For the large exporters, the premium for the individual policy should be reduced; and the premiums should be recovered from borrower/banker (PCFC from the borrower and PSFC from the bank) as in the case of WTP – This is as per the RBI circular RBI/2015-16/47 dated 1.7.15.

The effect of all the challenges facing the gems and jewellery industry is to reduce the Ease of Doing Business greatly for this sector. Hence, the GJEPC decided to meet the Union Minister.

Pramod Agrawal, Chairman, GJEPC said, “The Government has been very supportive to this labour-intensive sector which employs around five million people. There are a series of challenges faced by the sector, currently, across all business fronts. This has impacted the business adversely; and exports last month have declined by 21% with business being shifted to other competing markets such as HK, China and Thailand.”

He added: “We are expecting to resolve these issues with the help of the Government soon. We are confident and hopeful that the Government will continue to support the industry by bringing in trade-friendly policies and help retain the business in India.”

Listed below are the points on the basis of which GJEPC prepared its presentation to the Government.

Segment A: Diamonds: –

1. Appointment of Valuers at PCCC

2. Problems at PCCCC Customs

3. Proposed SOP for Valuation Panel at PCCCC

4. Implementation of Risk Management System (RMS) at PCCCC

5. Re-import of cut & polished diamonds sent against consignment

6. Re-introduction of facilitation circular for doing away with the requirement of making reference to SVB branch in case of import of diamond from related parties & Determination of value of CPD from Collaborator including its associates/Affiliates without reference to SVB

7. Accumulation of GST: Issues pertaining to the blockage of input tax credit (‘ITC’) due to inverted duty rate structure

8. Shortage of working capital due to banking issues

9.Allowance of job work for rough diamonds in both SEZ and DTA units

10. ECGC Issues:

11. High Import Duty on Cut and Polished Diamonds

Segment B : Gold:

1. Availability of gold

2. Pending Claims under Replenishment Scheme for the approved interim period ( i.e. 22nd July, 2013 to 14thFebruary, 2014

3. Partial discharge of bond

4. Appendix 4 O

5. Exemption of GST on supply of gold by nominated agencies to exporters against bond/bank guarantee

6. Bank Finance issues change in credit policy by bankers for jewellery sector

7. Shortage of Working Capital due to change in credit policy by bankers for jewellery segment

8. Problems in getting refund of IGST

Segment C: Coloured Gemstones

1. High import duty on cut and polished coloured gemstones

2. Availability of raw materials

Gaps in skill and technology

Courtesy: GJEPC

Wide Angle4 weeks ago

Wide Angle4 weeks agoIndia has overtaken China to become second largest diamond market: De Beers CEO Al Cook

Daily News1 month ago

Daily News1 month agoUS-based private equity firm Advent International to acquire Orra Fine Jewellery, say media reports

Exclusive2 months ago

Exclusive2 months agoThe House of Rose debuts in Mumbai with a 21,000 sq. ft. experiential concept space showcasing fine jewellery and luxury watch brands

Wide Angle1 month ago

Wide Angle1 month agoEminent jeweller Viren Bhagat sets up first global boutique in London’s Mayfair