RJ Market Watch

Zaveri Bazaar opens today after 10 weeks, traders feel it’s a positive sign

Zaveri Bazaar, Asia’s largest gold market, reopened on Friday, after 10 weeks of shuttering, injecting life into India’s tepid bullion and jewellery trade that relies heavily on this South Bombay commercial landmark for business volumes and leads.

Adhering to the odd-even formula spelt out by the Maharashtra government, 2,000 shops out of the 4,000 lined along the narrow and meandering Zaveri Bazaar lanes will open their shutters. Revival of the centuries-old Zaveri is crucial in helping restore commercial normalcy in downtown Mumbai, where the Bombay Stock Exchange, the central bank, bulge-bracket financiers and the gold market are in close proximity, having organically developed over the decades to create one of Asia’s biggest integrated business districts.

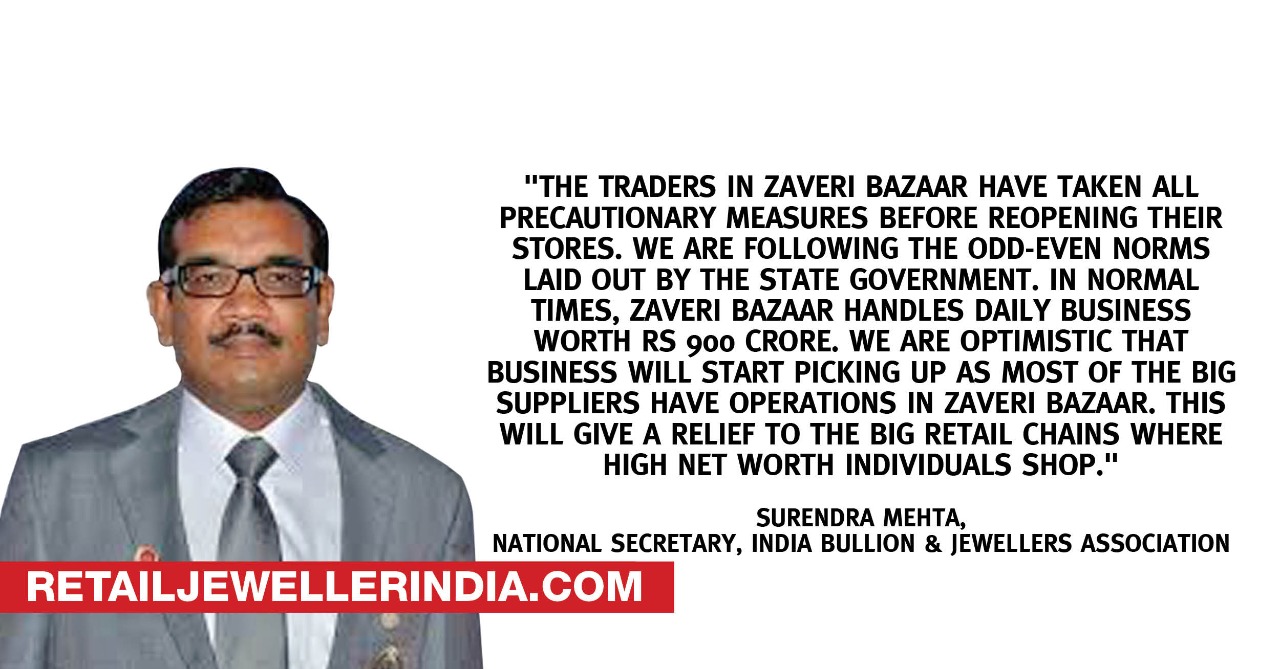

“The traders in Zaveri Bazaar have taken all precautionary measures before reopening their stores,” said Surendra Mehta, national secretary, India Bullion & Jewellers Association (IBJA). We are following the odd-even norms laid out by the state government.”

In normal times, Zaveri Bazaar handles daily business worth Rs 900 crore. Mehta is optimistic that business will start picking up as most of the big suppliers have operations in Zaveri Bazaar. “This will give a relief to the big retail chains where high net worth individuals shop,” he said.

Rajiv Popley, director of Mumbai-based Popley Group, said: “The reopening of Zaveri Bazaar will give a positive signal to the industry.”

Gold prices are trading off their all-time highs in India with future prices on MCX for Gold August contract witnessing minor correction lately, dropping 4% from the highs made at Rs 47,980 per 10 gm. The reopening of economic activity has improved risk sentiments globally.

Gold demand in India has remained subdued due to the nationwide lockdown. Spot gold markets were closed, affecting physical demand during Akshay Tritaya and the summer wedding season. However, investors switched to paper gold products and digital platforms to take advantage of price appreciation with the option to convert investments into physical gold, said Tapan Patel, senior analyst (commodities), HDFC Securities.

“We expect the market will take a few days to get fully operational in terms of gaining retail demand because of ongoing pandemic fears,” Patel said. “We expect slower recovery in physical demand for jewellery as stalled economic activities in the lockdown period have taken a toll on consumer spending. We expect gold demand to revive after the monsoons when people will look for festival buying and the winter wedding season.”

Patel said he expects gold prices in India to continue to trade firm in the medium term.

“We expect MCX Gold futures to trade higher, with a target of Rs 49,000 per 10 gm in medium term, with support at Rs 43,900 per 10 gm,” he added.

Courtesy: The Economic Times

Daily News4 weeks ago

Daily News4 weeks ago#LoveFromDad: De Beers unveils second ear-piercing drive to spur natural diamond demand among young consumers

Exclusive3 weeks ago

Exclusive3 weeks agoUS tariff storm hits India’s gem & jewellery industry; faces major disruption threat, 1 million jobs at risk

Wide Angle2 weeks ago

Wide Angle2 weeks agoTitan brings together Tanishq, Titan Watches and Titan Eye+ at first multi-brand store in the UAE

Wide Angle1 month ago

Wide Angle1 month agoSaashri Jewellers ropes in actor Samantha Ruth Prabhu for grand opening of new store in Sydney