RJ Market Watch

No protection for small depositors if jeweller defaults on gold schemes

For many in India, gold is not an indulgence but an investment. As a result, “gold schemes” which enable investment in the precious metal through equated monthly instalments (EMIs) are commonly are offered by jewellers across the country. The challenge before the common man is to identify the risk.

Goodwin Jewellers in Mumbai is only the latest in a round of failures by jewellers in honouring commitments to depositors. Small savers had similarly lost money to IMA Jewellery in Bengaluru, and Nathella Sampathu Chetty and Ruby Jewellery in Chennai. In the recent past, Kerala’s Thunchath Jewellers and Avathar Jewellers collapsed, sinking investor funds with them.

What happens to investors when a jeweller goes bankrupt or cheats? “As on date, investors have no protection whatsoever in these gold schemes if a company goes into liquidation. The individual investor’s deposit is usually a small amount, below Rs 1 lakh. That would not fall under the Insolvency Bankruptcy Code. It will be treated only as unsecured credit and, at the most, as trade advance,” said a former senior official with the ministry of corporate affairs.

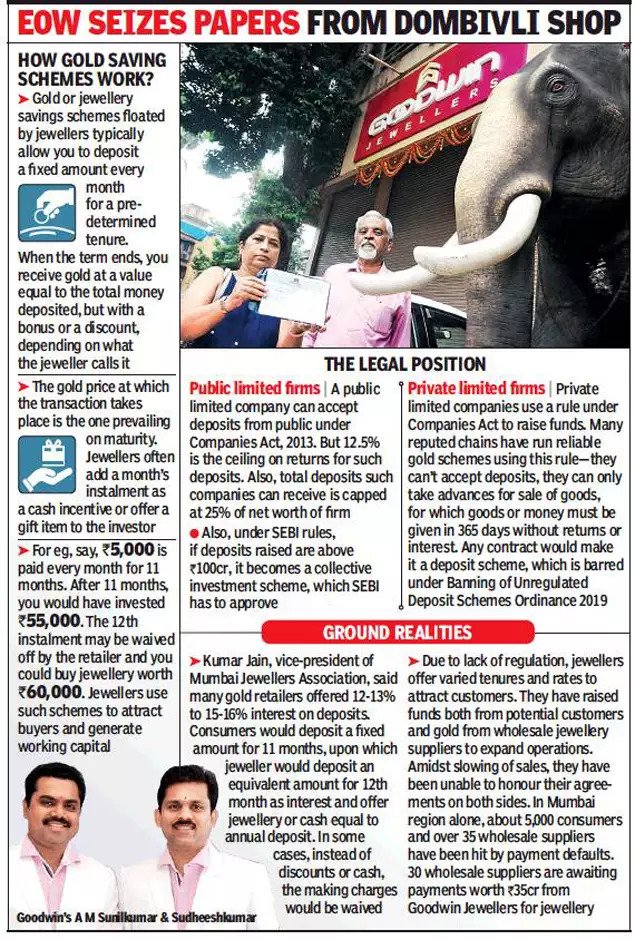

“ Sebi (Securities and Exchange Board of India) guidelines state if the deposit exceeds Rs 100 crore in any scheme, it becomes a collective investment scheme. For that, you need Sebi’s approval, which several companies do not get,” he said.

Most investors are not aware that only a few gold schemes are legal. It is thus important to ascertain whether the firm is public or private limited, a partnership or a proprietorship. “A public limited company can accept deposits from the public. The Companies Act 2013 provides with the statutory authority to do so. There is a 12.5% limit on the returns. Also, the total deposits such a company can receive are capped at 25% of the net worth of the firm,” said a legal expert.

Everyone from the corner goldsmith to corporate chains such as Tanishq offers gold schemes. Tanishq’s Golden Harvest Scheme, for one, generated deposits of Rs 1,273 crore during financial year 2018-19, up from Rs 1,041 crore in 2017-18, according to its annual report. Kalyan Jewellers, an unlisted public limited company, has been running gold schemes for close to three decades.

Companies have to be compliant whenever there is a regulatory change.

T S Kalyanaraman, chairman and managing director, Kalyan Jewellers, said, “The amended Companies Act was effective April 1, 2014. At that time, we communicated to customers to close their schemes and refunded their money. Then we operated a scheme that did not give any returns for almost two years, till the time we converted into a public limited company on June 15, 2016. We launched a product that was in compliance with the Companies Act in August 2016, in terms of the duration of the scheme and the return/benefit offered to the customer.”

There are private limited companies, too, which take deposits using Rule 2 of Companies Act. Some reputed jewellers have been incorporated as private firms and running reliable gold schemes for decades. “Private limited companies can’t accept deposits. However, they can take advances for sale of goods, for which the goods or money should be returned within 365 days without any returns or interest,” said the expert.

“Then there are firms which are not registered as either public or private limited companies. There is a question mark on the Act under which they operate their schemes,” he added.

Courtesy: Economic Times

Wide Angle4 weeks ago

Wide Angle4 weeks agoIndia has overtaken China to become second largest diamond market: De Beers CEO Al Cook

Daily News1 month ago

Daily News1 month agoUS-based private equity firm Advent International to acquire Orra Fine Jewellery, say media reports

Exclusive2 months ago

Exclusive2 months agoThe House of Rose debuts in Mumbai with a 21,000 sq. ft. experiential concept space showcasing fine jewellery and luxury watch brands

Wide Angle1 month ago

Wide Angle1 month agoEminent jeweller Viren Bhagat sets up first global boutique in London’s Mayfair