Prime Story

Gold Out For Mini-Bull Run, Aspiration to Boost Indian Jewellery Consumption: Metals Focus

Gold, a US$ 44 billion industry, is still in its nascent state in the jewellery vertical because of sheer lack of data. While uses of data are endless, the simplest of them may come to use to a retailer who might want to track his progress in the industry over time. Metals Focus, in association with World Gold Council, announced the launch of Annual Gold Focus 2019 in Mumbai on April 4.

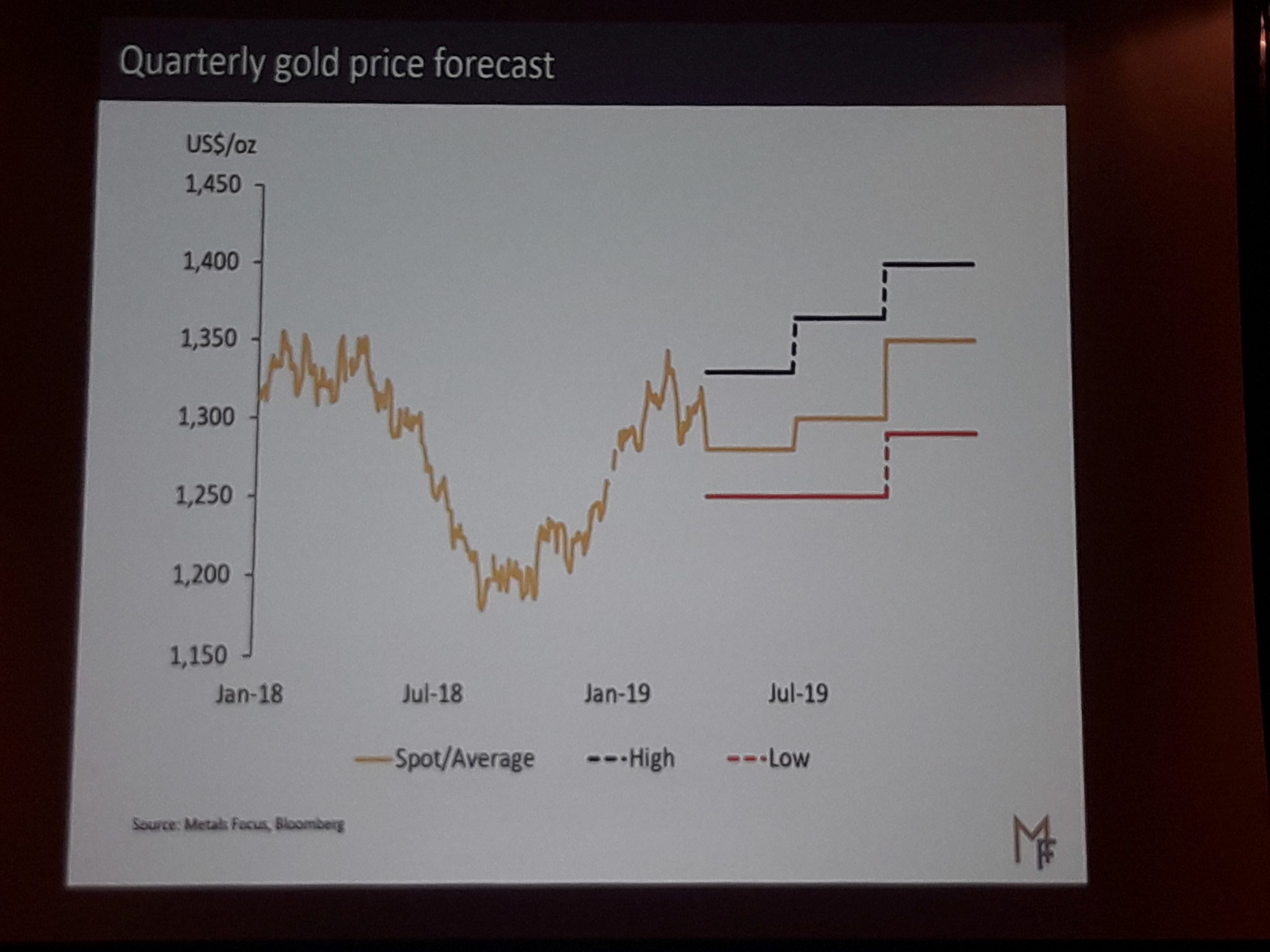

The rate hikes by Federal Reserve System, USA. Has been responsible for the increase in gold price, said Harshal Barot, Metals Focus while explaining the macro-economic backdrop. “Why has the dollar been so strong? Close to 2016, there were 9 rate hikes of which 7 have been in the past couple of years. Secondly, the Fed decided to taper its balance sheet to the tune of US$40 billion after 2017, which tightened financial conditions affecting gold price,” he said. When foreign equities perform well, gold as a non-yielding asset just gives return on price and so underperforms in comparison, he added. India faced two rate cuts in the last couple of months and chances of further cuts are negligible till the end of 2019 as central banks across globe are dovish, meaning they want people to spend more on resources and in this case, on gold to improve economic conditions of their respective nations. Judging the net-long position of investors for futures and options on the Comex, there is tremendous scope for investors to reap the benefits of rising price of gold in the near future.

Explaining the micro-economic implications of gold supply, Chirag Sheth of Metals Focus said mined supply of gold has seen a shift from South African countries towards Russia and China, although rising environmental concerns and poor market performance of gold price has led to thinning project pipeline and dwindling supply. “Almost 15% of world’s annual gold supply comes from artisanal gold mines. The explosion of non-LBMA refineries in the scene has dimmed the importance of artisanal mines as the former don’t often pay due diligence to ecological mining standards,” said Sheth. Pointing out how a 1% jump, i.e. an increase of 1100 tonnes of gold recycled in 2018 implies political and macroeconomic concerns for the Middle East and price hike in East Asian countries imply tendency to hold back selling, Sheth said the gross gold supply has increased in India but net supply has dipped because of increase in gold exchange. Starting Q4 of 2018, producers have been hedging on gold loans more, so supply stays to be positive.

The jump in demand from 4025 tonnes to 4364 tonnes in 2018 can be attributed to the official sector which invested more on gold. Jewellery consumption was up by 1% in India as compared to 6% in China, because of better innovation, product development and marketing strategy. “There is lack of concentrated marketing campaigns in jewellery in India. People in their countries are targeting the younger population while in India, retailers target buyers in or around 35 years of age. Indian jewellers acutely lack a product line for, say, a 10-18 year old buyer. So, we are catering to only 50% of our population,” inferred Sheth.

INDIAN MARKET

Dore imports are increasing in India but imports are restricted to 5-6 refineries having 80-85% market share, barring which all refineries run in low capacity. Indian jewellery consumption has braved oddities such as PAN card verification, PMLA, GST etc, has been resilient primarily because of bridal jewellery needs. With inventory costs going up and funding becoming harder, the new store expansion has been used by old gold movement rather than purchase of new gold. Thus fabrication is outstripping consumption of jewellery. Investment demand of gold jewellery is facing a structural change. Financially educated investors have options to invest in digital gold while jewellery consumption is battling tours and gadgetry. Impulsive purchase will come back to India as price of gold rises as rural economy still thrives on gold. “As farm income increases and rural India modernizes, impulsive purchase in gold will increase therein,” said Sheth. Discussing the corporatization trend, Sheth said regional and national brands comprise a 34% market share while standalone jewellers fill up the rest. “Regional and national brands are to increase till 40% by 2023 as they raise aspiration levels of buyers with brand value,” he said.

Demarcating the flattened yield curve of gold in U.S.A, Sheth said the debt levels in the United States and China are worsening and that the U.S. economy is nearing a recession point. “This, in 600 days, will lead to correction of equities in the U.S, which are richly priced and their correction would augur well for international price of gold,” he said. Gold is in for a mini-bull run and Metals Focus, thus, expects a US$600-650 for 2-3 years as of now.

Courtesy: Retail Jeweller India News Service

Wide Angle4 weeks ago

Wide Angle4 weeks agoIndia has overtaken China to become second largest diamond market: De Beers CEO Al Cook

Daily News1 month ago

Daily News1 month agoUS-based private equity firm Advent International to acquire Orra Fine Jewellery, say media reports

Exclusive2 months ago

Exclusive2 months agoThe House of Rose debuts in Mumbai with a 21,000 sq. ft. experiential concept space showcasing fine jewellery and luxury watch brands

Wide Angle1 month ago

Wide Angle1 month agoEminent jeweller Viren Bhagat sets up first global boutique in London’s Mayfair