Prime Story

Fura Announces AGM Results and Upsize of Private Placement

TORONTO, Aug. 15, 2019 — Fura Gems Inc. (“Fura” or the “Company”) (TSXV: FURA) (OTC: FUGMF) (FRA: BJ43), a new gemstone mining and marketing company with emerald and ruby assets in Colombia and Mozambique, respectively, is pleased to announce the results of its annual general and special meeting of shareholders (the “AGM”) held on Friday, August 2, 2019 in Toronto, Canada.

AGM Results

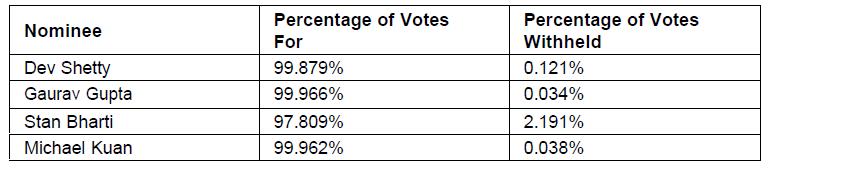

The nominees listed in the management information circular (the “Circular”), which was mailed to Fura’s shareholders of record as of July 2, 2019, were elected to the board of directors of the Company to hold office until the next annual meeting of shareholders or until their successors are duly appointed or elected.

A total of 57,005,463 Shares were voted at the AGM, representing approximately 42% of the issued and outstanding Shares.

In addition, Fura shareholders approved all of the other resolutions detailed in the Circular and put forward at the AGM, namely:

• Re-appointing UHY McGovern Hurley LLP, Chartered Accountants, as auditor of the Company for the ensuing year; and

• Approving the Company’s stock option plan for the ensuing year.

Fura shareholders also approved the two special resolutions detailed in the Circular and put forward at the AGM, namely:

• Approving the creation of new “Control Persons” (as that term is defined under TSX Venture Exchange (“TSXV”) Policy 1.1 – Interpretation), as more particularly described in the Circular; and

• Approving Lord of Seven Hills Holdings FZE’s participation in the Upsized Offering (defined below) as a “related party transaction” pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions, as more particularly described in the Circular.

Dev Shetty, President & CEO of Fura, commented:

“We are pleased that our shareholders approved Lord of Seven Hills Holdings FZE’s participation in the ongoing Upsized Offering. We expect that, upon completion, the capital raise will help Fura accelerate our operations in Colombia and Mozambique and move the Company along the path to revenue-generating mining operations.”

Michael Kuan of Lord of Seven Hills Holdings FZE commented:

“We are excited about our investment in Fura, which we believe has a world-class management team with a tremendous track record in the coloured gemstone industry. We see the coloured gemstone mining sector as highly fragmented, with approximately 90% of the sector still unorganised. We, therefore, look forward to supporting Fura’s management team and its strategy to consolidate the sector and transform Fura into one of the industry’s first consistent suppliers of emeralds, rubies, and sapphires.”

Private Placement Upsize

As a result of increased investor demand, the Company is increasing its previously announced private placement of Fura common shares (the “Shares”) from total gross proceeds of $30,375,000 to $33,337,500 (the “Upsized Offering”). The net proceeds of the Upsized Offering are expected to be used for: (i) the advancement of Fura’s Coscuez emerald project in Colombia and ruby assets in Mozambique, (ii) the closing of the Company’s ongoing acquisition of a 100% interest in ruby prospecting licence No. 5572L in the Montepuez District of Cabo Delgado province in Mozambique previously announced on July 26, 2018, (iii) the closing of the merger of ruby assets transaction first announced on July 16, 2018 respecting the Company’s acquisition of (A) 75% of the issued shares of Montepuez Minerals Pty Ltd., which owns a 70% interest in mining licence 5030L, and an 80% interest in mining concession 8921C; and (B) a right to earn a 65% interest in mining concession 8955C under a joint venture agreement, and (iv) general corporate purposes.

The closing of the Upsized Offering may occur in one or more tranches, with the closing of the first tranche expected to occur on or about August 16, 2019, and remains subject to receipt of all necessary regulatory approvals, including the approval of the TSXV. Fura is not paying any finder’s fees in connection with the Upsized Offering. The Shares issued pursuant to the Upsized

Offering will be subject to a regulatory hold period of four months and one day.

Further to the Company’s press releases dated September 17, 2018, and November 29, 2018, the Company confirms that C$4,752,124 of the net proceeds raised from the previously announced private placement that closed in September 2018 was not used to complete the closing of the Merger of Ruby Assets Agreement dated July 14, 2018, as amended, but was used for

general corporate purposes and developing its current mining assets.

About Fura Gems Inc.

Fura Gems Inc. is a gemstone mining and marketing company which is engaged in the mining, exploration and acquisition of gemstone licences. Fura’s headquarters are located in Toronto, Canada and its administrative headquarters are located in the Gold Tower, Dubai. Fura is listed on the TSXV under the ticker symbol “FURA”.

Fura is engaged in the exploration of resource properties in Colombia and owns a 76% interest the Coscuez emerald mine in Boyacá, Colombia. Fura is involved in the exploration and mining of rubies in Mozambique through its 80% effective interest in the four ruby licenses (4392L, 3868L, 3869L and 6811L).

Regulatory Statements

This press release may contain “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, statements regarding the election and appointment of directors, the Upsized Offering and the Company’s publicly announced acquisitions (the “Acquisitions”), the Company’s ability to complete

the Acquisitions, the market price of rubies and other gemstones, the Company’s exploration activities and mining activities and the Company’s performance. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: general business, economic, competitive, geopolitical and social uncertainties; the actual results of exploration, development and production activities; access to sufficient financing to continue the development of its assets; regulatory risks; risks inherent in foreign operations and the Company’s assets; legacy environmental risks; title risks; and other risks of the mining industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any securities in the United States. The securities referred to herein have not been and will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act”), or any state securities laws and may not be offered or sold within the United States or to, or for the

account or benefit of U.S. persons (as defined in Regulation S under the 1933 Act) absent such registration or an applicable exemption from such registration requirements.

Courtesy: Retail Jeweller India News Service

-

Daily News2 months ago

Daily News2 months agoBvlgari adds designs to its pathbreaking mangalsutra collection ahead of wedding season

-

Daily News2 months ago

Daily News2 months agoTrent, a TATA subsidiary, launches lab-grown diamond brand ‘Pome,’ shares surge 7.67%

-

Daily News2 weeks ago

Daily News2 weeks agoMalabar Gold & Diamonds launches ‘Heritage Show’ in Mangalore, featuring jewellery inspired by Maharanis

-

Daily News3 weeks ago

Daily News3 weeks agoSavji Dholakia’s visionary water conservation project ‘Bharatmata Sarovar’ reinforces commitment to sustainability